Germany Shows Why Europe Cannot Rely on Business-Led De-Risking

Conceived as a project to strengthen peace through economic cooperation, the European Union has faced a harsh reckoning with the rise of strategic dependencies and vulnerability to coercion as dominant concerns in international economic relations. As was the case with its reliance on Russian gas, Germany’s position is particularly critical due to its exceptionally deep integration into the global economy and dense linkages with China.

The country’s approach thus far, however, suffers from misconceptions about the role of business in fostering resilience that the EU more broadly should beware of in fleshing out its economic security strategy. Private sector engagement is undoubtedly critical, but it will take concerted public-private initiatives rather than mainly corporate risk management to succeed.

Germany’s De-Risking Delusion

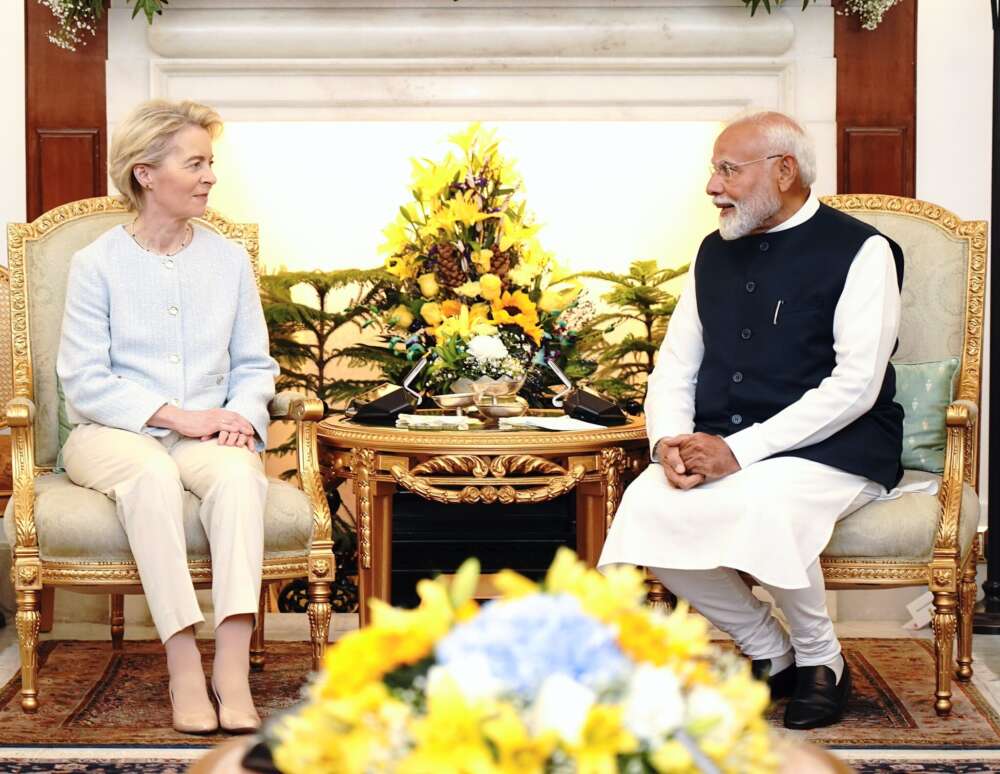

Chancellor Olaf Scholz has left no doubt whom he sees in the driver’s seat in addressing his country’s strategic dependencies: “De-risking is not a short-term project as it is mainly about decisions that need to be taken by companies,” he argued in June, using the de-risking tagline also embraced by European Commission President Ursula von der Leyen and now firmly established among a wide range of stakeholders.

The concept’s success is partly explained by its malleability – beyond indicating a more targeted approach than the dreaded “decoupling,” what precisely de-risking entails remains up to interpretation. However, more and more evidence casts doubt on whether the decisions that German companies are indeed taking amount to satisfactory de-risking progress by any plausible definition.

Critics of German companies’ handling of China-related risks have tended to focus on outward investment flows, which reached record levels in 2022 and have hardly subsided since. While this pattern is strongly shaped by a few large firms, supply chain dependencies arguably constitute a more important issue, as they concern a much larger array of companies.

In a recent Bundesbank survey, almost a third of responding firms indicated reliance on critical inputs from China, and almost 80 percent of these companies reported that those would be “difficult” or “very difficult” to replace. Only about 40 percent had yet taken any concrete measures, with least action among those who had indicated that reducing dependencies would be difficult.

These findings are consistent with analyses by economic institute IW of industry-relevant products with concentrated import dependencies on China, showing that these dependencies have decreased significantly over the past year for only a handful of product groups. For almost half of the relevant product groups, these dependencies have stayed the same or even increased further.

Systemic Vulnerabilities, Individual Responses: The Limits of Corporate Action

Relying on business-driven de-risking implies a view of present dependencies as mainly a failure of corporate risk management. Foreign Minister Annalena Baerbock framed this explicitly as a “moral hazard” problem when presenting the German China strategy, admonishing firms not to rely on “the strong arm of the state” when facing the consequences of excessive exposure.

Though relevant in select cases, this framing threatens to misdirect efforts in at least two important ways. First, it ignores how corporate risk management logic, especially in highly internationalized firms, diverges from government priorities. For companies already heavily invested in China and serving local and regional markets, for instance, further localizing operations can be a plausible risk mitigation measure. This goes some way toward explaining recent investment levels, but it does not advance Germany’s economic security.

Second, it overestimates most companies’ ability to generate diversification options where those are missing at the systemic level. China’s overwhelming dominance as a supplier of rare earths, for example, reflects a decades-long failure to build and maintain processing capacity at home or elsewhere in the world through targeted industrial policy.

There currently simply are not many serious alternative suppliers offering, say, neodymium, a key ingredient for magnets and thus electrical motors or wind turbines. Few companies have the scale and resources to single-handedly drive upstream capacity building.

Coordinated industry initiatives may be more promising but are challenging to organize. As the Bundesbank survey shows, it is, therefore, precisely in these areas where systemic supply chain dependencies are gravest that business-driven de-risking is most conspicuously lacking.

Building Public-Private Partnerships for Systemic De-Risking

Instead of counting on corporate risk management to save the day, policymakers should think more carefully about how to leverage private sector engagement for systemic de-risking efforts. This starts by identifying vulnerabilities, which often requires deep expertise on industrial ecosystems, production processes and market dynamics.

Public institutions – be it at the member state or EU level – rarely possess such knowledge, making more substantial and effective private sector consultation imperative. Building on this analysis, fostering diversification options at scale and speed will likely require what University College London economist Mariana Mazzucato has called “mission-oriented” partnerships between public and private actors, a step change from doling out subsidies or traditional industrial development financing. Adequate structures and policies are needed to enable such ventures.

Rightly, the June 2023 EU joint communication on an economic security strategy called for a “structured dialogue with the private sector” – high up on its list of next steps. Joint or at least coordinated EU efforts clearly hold significant potential for synergies, both in building a stronger analytical foundation and designing impactful interventions.

For all the caveats mentioned, it is also reasonable to presume some shared basis with the private sector for this engagement, as the ultimate goals of de-risking are in the enlightened self-interest also of any business actor with a significant base in Europe. But it is time to throw out illusions about business-led de-risking and to engage companies in a way that can make a genuine difference.

This commentary was originally published on the Bertelsmann Foundation’s Global & European Dynamics blog on January 23, 2024.