Time to Get Serious with “De-Risking”

“De-risking” is now firmly established as a central concept of China policy on both sides of the Atlantic. In a March 2023 speech, European Commission President Ursula von der Leyen argued that Europe should “de-risk – not decouple.” German Chancellor Olaf Scholz first used the term a few months earlier. The German government’s China Strategy, published in June 2023, also states that “de-risking” is “urgently needed,” but that Germany is “not pursuing a decoupling of our economies.” Similarly, in September 2023, US President Joe Biden declared when addressing the UN General Assembly: “We are for de-risking with China, not decoupling.”

Critical observers have followed the watchword’s rapid rise with skepticism. Sabine Stricker-Kellerer, chairwoman of the German-Chinese Dialogue Forum, remarked at the launch of the German China Strategy that de-risking’s universal popularity is a “bad sign” that “everyone can somehow accommodate their [own] narrative.” Indeed, the term’s elasticity best suits those who wish to change as little as possible in Germany’s economic relations with China – including a number of powerful industry players.

Companies Doubling Down

While in Brussels last June, Scholz stressed the importance of not having “any strategic dependencies – not companies, not national economies.” In nearly the same breath, Scholz also claimed that it was not up to the government to reduce these dependencies, but rather the task of companies. This is a problematic, if not outright dangerous, proposition. Some corporations, especially those that dominate public perception with major investments in China, have a completely different interpretation of the risks involved in dealing with the country. They are doubling down on their bets in favor of the Chinese market, hoping to weather political storms through an increasingly localized business model of “in China, for China.” For Mercedes CEO Ola Källenius, de-risking therefore means investing more, not less, in what he affectionately calls the company’s “second home.” BASF’s outgoing CEO Martin Brudermüller, who left his position at the end of April, has expressed similar views.

In February of this year, Chinese news agency Xinhua rejoiced about record German investments in China, going so far as to claim that “German companies are ignoring the preaching of ‘de-risking.’” This diagnosis goes well beyond Chinese state media spin and applies similarly to supply chain dependencies. In a mid-2023 survey conducted by the Bundesbank, 80 percent of the companies covered stated that critical intermediate goods from China were “difficult” or “very difficult” for them to replace; at the same time, most had not yet taken any measures to reduce such dependencies. Berlin’s inability or unwillingness to make a final decision on the role of Chinese companies in its 5G critical infrastructure – after five years of debate – completes the picture.

The overall impression is that Germany only half-heartedly supports the European Commission’s ambitious agenda on “economic security.” Even more striking is the contrast with the US government, which is both vigorously advancing technological restrictions on China and investing in the revitalization of its own industries. Germany and Europe cannot and should not copy Washington’s approach, but they cannot afford to ignore it, either. They must define their own agenda – in dialogue with like-minded countries, including the United States, which is an indispensable security partner for the foreseeable future despite all antagonisms and uncertainties. Going down this path requires policymakers in Berlin to develop much greater clarity about the goals, dilemmas and instruments of de-risking.

Chinese Military Modernization

Economic dependencies are clearly the focus of the German de-risking debate. Far less attention is given by German policymakers to the risk that Western technologies are contributing to China’s military modernization. The German China Strategy does mention “preventing the cutting-edge technologies we develop from being used to further military capabilities that threaten international peace and security.” However, this goal has not been a real priority. Even the basic question of which specific technologies are potentially militarily relevant – and in what respect – is hardly discussed outside of narrow expert circles.

Things are very different in the United States, where the Biden administration is pursuing an entirely new doctrine – articulated by National Security Advisor Jake Sullivan in September 2022 – of maximum superiority over China in the realm of “critical and emerging technologies.” This new strategy represents a paradigm shift. Previously, Washington had aimed to maintain a relative advantage over adversaries such as China. Current technological developments, however, are so fundamental, according to the Biden administration, that the United States and its allies must “maintain as large a lead as possible” over strategic competitors (read: China) by maintaining controls over time and significantly strengthening barriers to unwanted technology transfers.

On semiconductors, the US government has already established far-reaching export controls that not only ban the sale of certain goods and equipment to China, but also prohibit US citizens from working at Chinese semiconductor companies. Additionally, Washington has not hesitated to exert pressure on allies that play an important role in this globally integrated industry, especially Japan, the Netherlands and South Korea. Berlin is also increasingly coming under scrutiny, as German companies (Zeiss and Trumpf in particular) contribute key components for the most advanced method of chip production. In accordance with the slogan “small yard, high fence,” the Biden administration has promised that only a small area of key technologies will be affected by “high fences,” or advanced controls. However, the list of technologies classified as critical has grown significantly within just a few months; in addition to semiconductors, quantum technology and artificial intelligence, areas such as biotechnology are also quickly coming into focus.

In developing their own approach, Germany and Europe should ask critical questions regarding the new US agenda. Are all the measures taken squarely to contain Beijing’s military ambitions, or are they more broadly aimed at crippling China’s economic development? Do governments possess a knowledge base sufficient to be able to intervene in a targeted manner? How effective are the measures? What are the unintended side effects?

On balance, it is not yet clear whether the new restrictions truly advance the interests of the United States and its allies. Beijing has long been trying to become more technologically independent – well before any paradigm shift in Washington took place. Nevertheless, the Biden administration’s aggressive approach has provided additional incentives for China to accelerate these efforts (and unlocked billions in government funding). The Chinese leadership seems highly unlikely to reverse course on this matter again, even if it were to receive more conciliatory gestures. The optimistic scenario holds that technology restrictions on advanced semiconductors will set back Chinese development by several years. If, however, despite the restrictions imposed, China was able to quickly expand its own capabilities, then the result for the West would be negative: Western companies would lose market opportunities without hampering Chinese military development.

Another question is that of scope, or the “yard size,” to use the Biden administration’s wording. Clearly, Germany and Europe have little appetite for an ever-broadening yard that could result in an escalating spiral of technology restrictions and retaliatory measures. But a narrow yard is hard to justify considering the countless applications of advanced computing capacity and artificial intelligence, as well as China’s deliberate policy of “civil-military fusion.”

The Bigger Picture

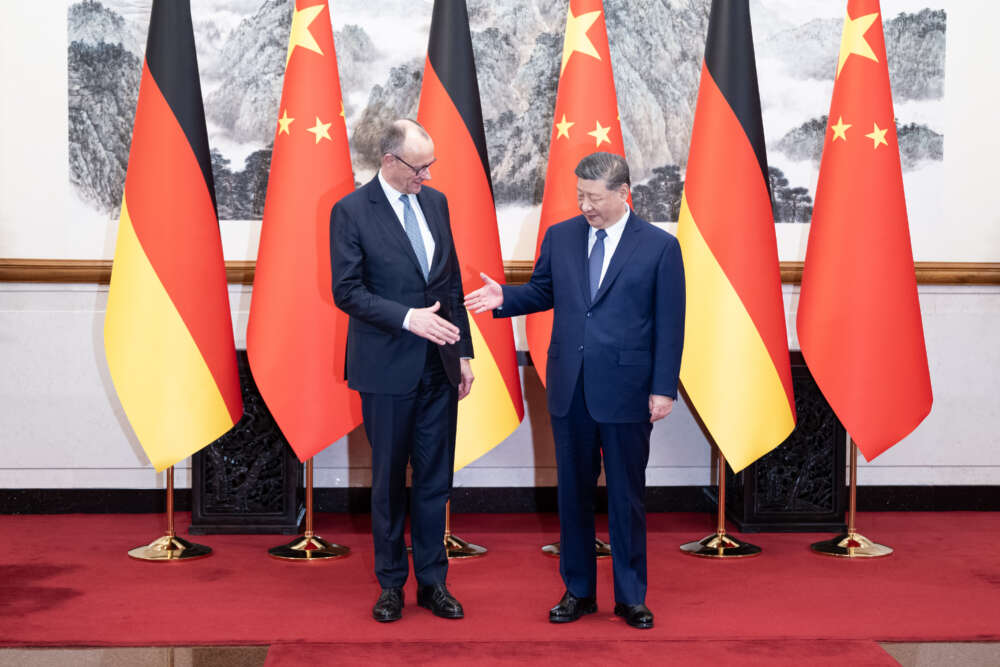

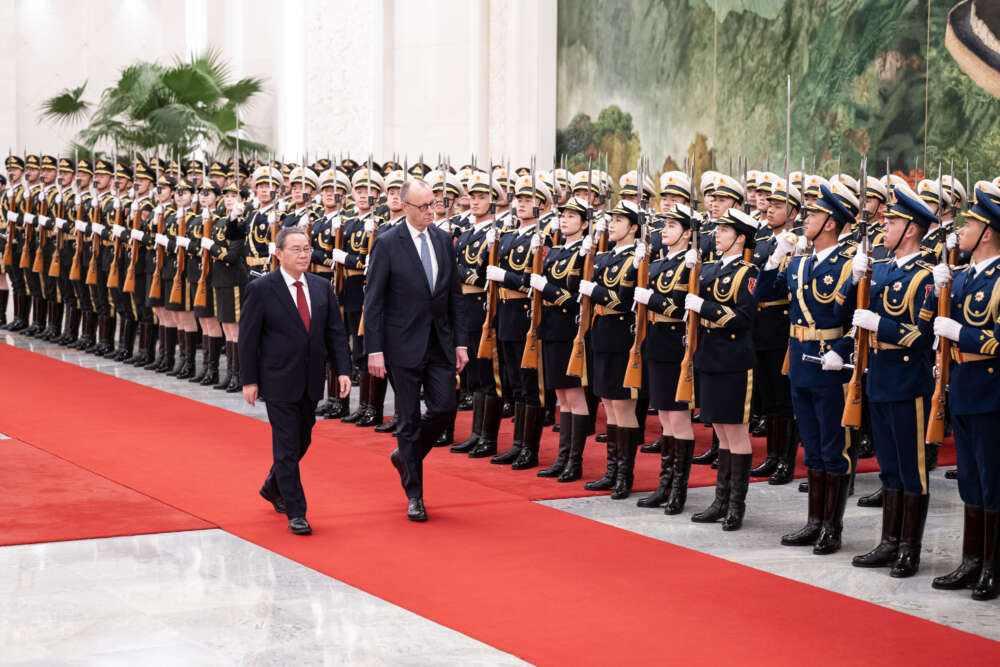

While asking critical questions, German and European policymakers should not lose sight of the bigger picture in terms of peace and security. In late March, Chinese President Xi Jinping complained to Dutch Prime Minister Mark Rutte about export controls in the semiconductor sector, stating, “the Chinese people also have the legitimate right to development.” While correct, that is not the issue at hand. The point is that Beijing certainly has no inherent right to pursue military modernization with Western technologies.

The more doubts Chinese leaders have about the capabilities of their own military in direct conflict with the United States and its allies, the greater the chances of peace and stability in the Indo-Pacific. In this respect, export controls on militarily relevant technologies are conducive to peace. This dimension of the problem must also be taken seriously in Germany – also to have at least a chance of shifting the at-times-overheated US debate toward an evidence-based approach and better multilateral coordination.

To get serious, it is important for Germany and Europe to go beyond general classifications of “critical technologies” and develop well-founded positions on specific applications and suitable control measures, especially with regard to topics that have been little-discussed to date, such as biotechnology. Regarding research cooperation, the German China Strategy correctly states: “We are taking into account the fact that civilian research projects, including basic research, are also being considered by China in strategic terms with respect to their military use.” The same considerations must also take place in Germany as a prerequisite for informed risk management – and not just reactively when a concrete research, investment or export project is decided, but as a forward-looking analysis of possible developments and formulation of political responses.

Dealing with Dependencies

While the German discussion on dependencies and vulnerabilities is already more advanced, too many fundamental questions so far remain unanswered. Which specific dependencies are “strategic?” What are the risk scenarios? What potential damage is acceptable, and at what threshold must preventive measures take effect? How and with which targets can we best reduce dependencies?

Several different types of risks faced by European economies are rightly highlighted in a June 2023 EU strategy paper, including threats to critical infrastructure (communications, transport, energy), supply chains disruptions, (critical raw materials, preliminary and intermediate goods and products), and market dependencies (access to export markets and target markets for direct investments abroad). Although each of these aspects has its own particularities and deserves more detailed treatment than this article allows, two fundamental concerns are key. First, the economic damage in the event of a conflict, such as loss of supplies, loss of sales markets and investments, and sabotage of critical infrastructure. And second, the vulnerability to coercion and the constraints on the political room to maneuver resulting from this potential damage.

In Germany, the lived experiences of Russia’s energy blackmail while also witnessing Beijing’s coercive measures against Lithuania and Australia have highlighted these dangers. However, the attempt to reduce dependencies by primarily making vague appeals to the private sector has been a failure. In addition to differences in risk interpretations between the government and industry, there is also a structural collective action problem.

The vast majority of companies are simply not in a position to eliminate industry-wide concentrations of supply chains or to open up new sales markets that could even come close to replacing their current income from business in China. “There is no second China” is often far more than a cheap excuse. Nor can companies in core European industries protect themselves against unfair competition from state-subsidized Chinese rivals on their own.

Without some type of state intervention, it will hardly be possible to prevent the European wind power industry from being squeezed out in the same way as the European solar industry was. On electric vehicles, unfair competition exacerbates the impact of European companies’ own sluggish adjustment to new technological realities. As China expert François Godement warns, a plausible alternative to protective measures is the death of the European auto industry “which will be neither slow nor painless.”

A Clearer Vision

For their part, the European Commission and the German government must therefore define a clearer vision and develop a coherent mix of political measures. The commission has shown a willingness to step up but can achieve little without greater commitment from central member states. Germany should set the tone by leading on the next steps outlined in the EU strategy, including the creation of a common framework for risk analysis and engagement in structured dialogue with the private sector.

These steps are rightly aimed initially at strengthening the knowledge base for decisions. All too often, discussions continue to revolve around circumstantial evidence such as aggregated import statistics, which falls short of any kind of serious risk assessment. Given the immense costs of possible state interventions, of which Germany’s subsidies for semiconductor factories offered just a taste, future decisions must rest on a more solid foundation. The key metric here cannot be the volume of domestic production capacities or the concentration of a step of a supply chain in China, but rather the damage that is to be feared if relevant crisis scenarios materialize. So far, only the Kiel Institute for the World Economy has presented a first stab at this type of modeling, at a very general level. More detailed analyses will require access to sensitive information and data from companies on supply chains and technologies, for which there is currently no suitable framework.

Sharpening risk analysis in this way would also counteract the tendency, when it comes to targets and measures, to focus excessively on expanding domestic industrial capacities. For example, the EU Critical Raw Materials Act calls for the development of European capacities to process 40 percent of the critical raw materials consumed on the continent by 2030. This target hardly seems achievable at a reasonable cost. Nor does it appear necessary in terms of security policy.

Even if it is politically easier to defend industrial policy with the argument of job creation, risk reduction can also be achieved through global diversification. The German government, in its agenda of global partnerships with countries in the so-called Global South, rightly emphasizes anchoring parts of the value chain in raw materials processing in those countries, but further efforts are needed to turn political intent into reality on the ground. Comparatively straightforward measures such as strategic stockpiling or better recycling quotas must also always be part of the discussion.

Meanwhile, the argument of potential political and economic costs cannot be used as an excuse to avoid acting decisively to reduce vulnerabilities in critical infrastructure. Germany’s 5G debate is a prime example of how the fear of retaliation based on the market dependencies of German companies in China has prevented decisive action in this area. German officials must learn from this debate, which has been driven by fear, misinformation and outright disinformation, and take a much more determined approach to the security risks posed by Chinese electric vehicles, for example.

Talking with Each Other

Despite (or perhaps because of) the use of the same de-risking terminology, Europe and the United States have often talked past each other over the last two years. In the US, the question of the military balance of power with China is far more of a pivotal issue than in Europe. In theory, the Biden administration’s “small yard, high fence” approach offers a path toward containing China’s military ambitions in the Indo-Pacific while maintaining economic relations in non-critical areas.

Given the central role of domestic political dynamics in both Washington and Beijing, whether and how this succeeds in practice is only partly in Europe’s hands. Berlin and Brussels can only credibly work toward a sound balance if they get serious about playing their part in denying Beijing access to technologies key to military modernization. Without visible progress on this front, the pressure from Washington to put more restrictions on business with China across the board will continue to grow — regardless of who sits in the White House. That said, a re-elected President Donald Trump would be far less reluctant than the Biden administration to use European dependencies vis-à-vis the United States as a tool to bring Europe into line. German policymakers need to be ready.

This commentary was published in IP Quarterly on April 26, 2024. A German version first appeared in Internationale Politik on April 16.