Calculating the Costs of Decoupling

Some Caveats from the Real World

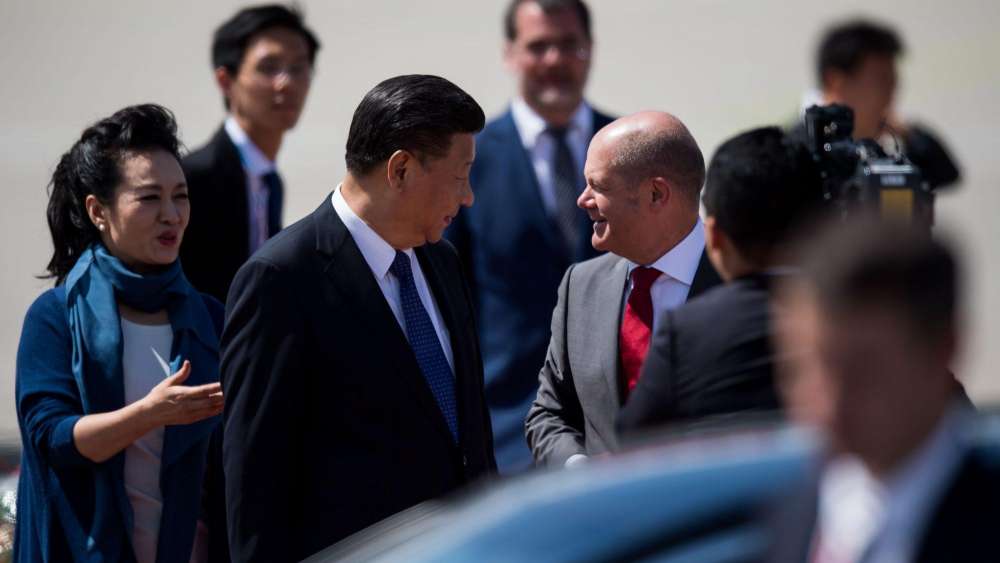

During the last G7 summit in May 2023, members struggled to find common ground on the issue of “decoupling” their economies from China. In their final communique, they settled for a supposedly more limited “de-risking” strategy. Despite the long hours spent on crafting the compromise, it still seems unclear what either of these terms actually entails. Most importantly, no one seems to have an idea how much decoupling or de-risking might cost us. A recent study by the German Kiel Institute for the World Economy, a leading economic policy research institute, is therefore all the more welcome. It calculates the potential impact of different decoupling or de-risking scenarios for the German economy. Unfortunately, the scenarios assessed are not realistic, and hence the conclusions it draws are problematic.

A Welcome Empirical Approach

In the executive summary, the authors present the study as a quantification of “a hard decoupling between China and Germany … in the context of a conflict over Taiwan.” Their worst-case scenario assumes a complete disruption of trade between China (and its allies North Korea and Russia) and Germany, as well as a redirection of such trade to other either neutral or friendly trading partners. The study estimates that, in the short run, such a “cold turkey” scenario would lead to a loss in Germany’s Gross National Expenditure (GNE) of 5 percent in the first month and a 4‑percent loss for the first year. In the long run, the authors estimate these losses to amount to 1.5 percent of GNE annually.

An important aspect of their analysis is the assumption that trade is elastic – the higher the elasticity, the easier it would be to redirect trade flows. Based on the Le Chatelier Principle, first introduced by American economist Paul A. Samuelson, this elasticity is expected to increase over time – hence the decreasing negative impact of a complete decoupling on GNE. Based on these estimates, the authors claim that the short-term economic impact of a cold-turkey scenario “is comparable to the global financial crisis and COVID-19 pandemic,” but they also go on to conclude that “these costs, though severe, are manageable.”

Enter (Geo)Politics

While the authors’ empirical approach to assessing decoupling is needed and should thus be welcomed, the Kiel Institute study has two major weaknesses that make it rather problematic.

The first problem is its narrow understanding of the broader effects of crises. The authors’ thesis that Germany has dealt successfully with similar crises in the past and therefore should have confidence in its ability to face another shock not only deviates quite far from the empirical core of the study – it also ventures deep into political territory. Has Germany really managed the financial crisis and the effects of the COVID-19 pandemic successfully? How can we measure this – particularly the impact these crises have had on society – beyond narrow economic metrics like GDP? If we look at real-world developments, Germany’s political landscape has changed beyond recognition over the last years. The Alternative für Deutschland (AfD), a far-right-wing party, now regularly scores election results over 20 percent. Populism is on the rise. Trust in Germany’s established political parties, parliament and democracy is falling rapidly. How many shocks is one too many?

Secondly, and more importantly, the Kiel study rests on very technical and, again, overly narrow scenarios that might be justified by the methodology but should not be mistaken for an accurate representation of the real world. Take, for instance, the above-mentioned cold-turkey scenario: a complete halting of trade between China and Germany would certainly not happen in a vacuum. In fact, it is completely implausible that the effects of a Taiwan crisis, which is mentioned in the study as the catalyst of a cold-turkey scenario, would be limited to a redirection of bilateral imports and exports between these two countries. Such a cessation of commerce would only be conceivable in an environment where a lot more would happen simultaneously.

Most corporate and military scenario exercises now include a worst-case scenario that describes how a war between the US and China in the South China Sea, triggered by a confrontation over Taiwan’s independence, will likely play out. This scenario entails a severe disruption of all trade links running through the South China Sea, including supplies for the production of semiconductors – goods which have almost zero trade elasticity. The capacities of Taiwan’s fabs, or semiconductor fabrication plants, cannot be replaced at all. This semiconductor problem does not show up in the study since Taiwanese semiconductor exports do not fall under trade relations between Germany and China. But it would nevertheless severely disrupt the global economy, including for German companies relying on these irreplaceable parts.

Any realistic worst-case scenario on Taiwan would also have to include a severe disruption of global financial markets, as the Atlantic Council and Rhodium Group have rightly pointed out. If China were to annex Taiwan, a complete breakdown triggered by an exclusion of China’s financial institutions from the SWIFT banking system cannot be ruled out. In such a world, the global economy would tank – probably in the most dramatic fashion since the global economic crisis in 1929. How “manageable” would that scenario be?

Needed: A Wider Lens

The problem with the study is that the authors themselves are presenting the narrow thought exercise of a decoupling of trade flows as a “Cold War 2.0‑like scenario” – which it is not. It is an analysis of only one impact vector. To stay within the Cold War analogy: it would be like calculating the impact of a nuclear war by solely focusing on the disruption triggered by the destruction of harbors and roads in only two countries. Moreover, the study does not justify its framing of a worst-case scenario as “manageable” in the real world. That it describes one potential trajectory in an empirical fashion is laudable – but the political assessment presented by the authors cannot be justified by their analysis.

“Manageability” suggests we know what might hit us and that we can handle it. It also invites policies of brinkmanship: taking more risks. But until we understand better what a geopolitical crisis with China really means for the world, we should be more cautious with our conclusions.